PAYE vs Self-Employed Tax in New Zealand

Taxation is an essential part of managing income, whether you are employed under PAYE (Pay As You Earn) or self-employed. Understanding the differences between these two tax structures in New Zealand is crucial for anyone planning their financial future. While both systems aim to collect tax on earnings, they differ significantly in terms of how taxes are paid, when they are paid, and who is responsible for the payments.

This guide will walk you through the key differences between PAYE and self-employed tax in New Zealand, highlighting their advantages, disadvantages, and everything you need to know to make an informed decision on which system is right for you.

PAYE Tax in New Zealand

How PAYE Works for Employees

PAYE is a system where tax is automatically deducted from an employee’s wages or salary by their employer. Employers are responsible for calculating, deducting, and paying the tax directly to Inland Revenue. This system ensures that taxes are paid regularly, and employees don’t have to worry about filing their taxes themselves unless they have additional income.

In this setup, employees don’t need to worry about managing their taxes, as it’s handled directly from their pay. This makes PAYE a relatively straightforward and hassle-free system for most people.

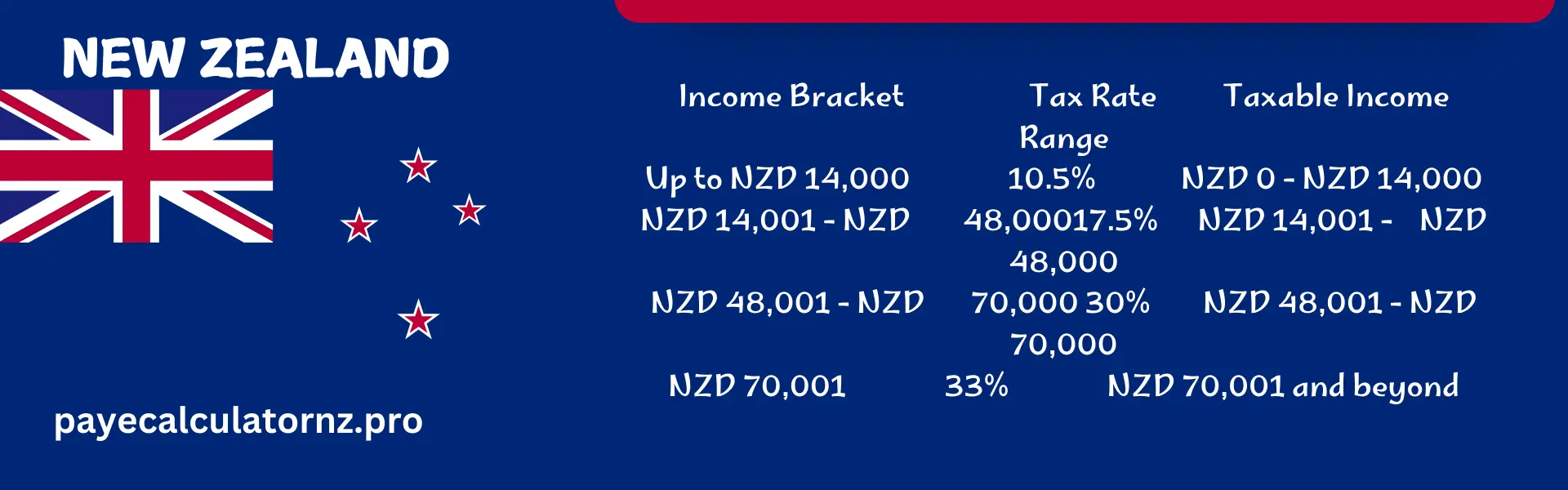

PAYE Tax Rates and Brackets

New Zealand operates a progressive tax system where the more you earn, the higher the percentage of tax you pay. Here’s a breakdown of the current PAYE tax brackets:

| Income Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| Up to NZD 14,000 | 10.5% | NZD 0 – NZD 14,000 |

| NZD 14,001 – NZD 48,000 | 17.5% | NZD 14,001 – NZD 48,000 |

| NZD 48,001 – NZD 70,000 | 30% | NZD 48,001 – NZD 70,000 |

| NZD 70,001 and above | 33% | NZD 70,001 and beyond |

Employees who earn more than NZD 70,000 annually will pay a maximum tax rate of 33% on the income above that threshold. As a result, PAYE employees in New Zealand face tax brackets that increase with their income, ensuring that higher earners pay a larger proportion of their income in tax.

Deductions and Contributions

Employees under the PAYE system also contribute to various other funds, such as KiwiSaver and, in some cases, student loan repayments. These contributions are deducted by the employer, who then pays them to the respective funds.

| Contribution Type | Details |

|---|---|

| KiwiSaver | Automatically deducted from salary for retirement savings |

| Student Loan Repayments | Deducted based on income and loan balance |

2. What is Self-Employed Tax in New Zealand?

Tax Obligations for the Self-Employed

Self-employed individuals in New Zealand are taxed on their income through the IR3 tax return system. Unlike PAYE, where tax is automatically deducted, self-employed people are responsible for calculating their income, determining their tax obligations, and making payments directly to Inland Revenue.

Self-employed individuals typically pay their taxes in the form of provisional tax, which is paid in advance based on estimated income. This system can require more proactive financial management than PAYE, but it allows individuals to claim various business-related deductions.

Tax Rates for Self-Employed

Similar to PAYE employees, self-employed individuals in New Zealand are taxed at the same progressive rates:

| Income Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| Up to NZD 14,000 | 10.5% | NZD 0 – NZD 14,000 |

| NZD 14,001 – NZD 48,000 | 17.5% | NZD 14,001 – NZD 48,000 |

| NZD 48,001 – NZD 70,000 | 30% | NZD 48,001 – NZD 70,000 |

| NZD 70,001 and above | 33% | NZD 70,001 and beyond |

However, unlike PAYE employees, self-employed individuals must manage their tax payments on their own, which means budgeting for tax payments is essential to avoid penalties and interest.

Deductions and Expenses for the Self-Employed

One major advantage of being self-employed is the ability to claim a wide range of business-related expenses as tax deductions. This could include things like:

- Office supplies: Stationery, equipment, etc.

- Travel: Business-related travel expenses.

- Home office costs: A portion of rent, electricity, and internet if you work from home.

These deductions reduce the overall taxable income, making it a potentially more tax-efficient system for those who run their own businesses.

| Deduction Type | Examples |

|---|---|

| Business Expenses | Office supplies, marketing, etc. |

| Travel | Business-related travel costs |

| Home Office Costs | Portion of rent, utilities |

3. Key Differences Between PAYE and Self-Employed Tax

Control Over Tax Payments

- PAYE: Tax is automatically deducted by the employer, so the employee doesn’t have to manage it.

- Self-Employed: Self-employed individuals are responsible for managing their own tax obligations, including calculating and making payments.

Tax Payment Frequency

- PAYE: Taxes are deducted automatically from each paycheck, which means employees don’t have to think about it.

- Self-Employed: Taxes are paid in advance as provisional tax, typically quarterly or annually, depending on income.

Deductions

- PAYE: Employees can claim limited deductions, such as student loan repayments and charitable donations.

- Self-Employed: Self-employed individuals can claim a wide range of business expenses, reducing their taxable income.

Employer Contributions

- PAYE: Employers handle the KiwiSaver contributions and make payments directly to Inland Revenue.

- Self-Employed: Self-employed individuals must make their own KiwiSaver contributions, usually on a voluntary basis.

4. Pros and Cons of PAYE vs. Self-Employed Tax

Pros of PAYE Tax System

- Convenience: No need to worry about calculating or paying taxes yourself.

- Stability: Regular tax payments that are automatically deducted from your salary.

- Predictability: You know exactly how much you will earn after tax deductions.

Cons of PAYE Tax System

- Limited Deductions: Employees can’t claim business-related expenses to reduce taxable income.

- Less Control: No flexibility in tax management or structuring your income.

Pros of Self-Employed Tax System

- Tax Deductions: Self-employed individuals can claim a broad range of deductions for business-related expenses.

- Control Over Taxes: More flexibility in managing taxes and potentially reducing taxable income.

- Potential for Higher Earnings: With the ability to control pricing and business expenses, self-employed individuals have more opportunities for higher earnings.

Cons of Self-Employed Tax System

- Increased Responsibility: Self-employed individuals must manage their own taxes, which can be complex.

- Quarterly Payments: Provisional tax payments may be difficult to manage with irregular income.

- Risk of Penalties: Late payments can result in penalties and interest charges.

5. How to Choose the Right Tax System for You

Factors to Consider

- Job Stability: If you prefer a steady, predictable income, PAYE may be better.

- Business Ownership: If you run your own business or have freelance income, the self-employed tax system offers more flexibility and potential savings.

- Tax Management: If you’d rather not worry about managing your taxes, PAYE is simpler.

What’s Best for You?

- PAYE is best suited for individuals with a stable job and regular salary.

- Self-Employed tax is ideal for business owners or freelancers who want more control over their income and tax deductions.

Frequently Asked Questions (FAQ)

Can I switch from PAYE to self-employed tax?

Yes, it’s possible to transition from PAYE to self-employed tax status. However, you must notify Inland Revenue and ensure you meet all obligations for self-employment, including filing an IR3 tax return.

What are the tax deadlines for self-employed individuals?

Self-employed individuals typically pay their taxes quarterly, with the first provisional tax payment due on July 7th. You must also file your annual tax return by July 7th of the following year.

Conclusion

Understanding the differences between PAYE and self-employed tax systems in New Zealand is crucial for effective financial management. Whether you’re an employee or a self-employed individual, both systems offer unique advantages and challenges. If you prefer convenience and stability, PAYE might be the right choice for you. However, if you have a business or freelance income, the self-employed tax system offers greater flexibility and the opportunity to reduce your taxable income through business deductions.

Choosing the right tax system will depend on your income structure, tax preferences, and level of control you want over your finances. For more complex tax situations, it’s always advisable to consult with a tax professional to ensure compliance and optimize your tax strategy.